Last week the economist Richard Thaler won the Nobel Price in Economics for his work that explains that people behave irrationally. Well, duh, right? Anyone who has ever been to a frat party can tell you all about irrational behavior. What Thaler did was apply this to economics by trying to measure and predict how humans will “misbehave”, or not act in their own best interest. Thaler believes most individual investors have behavioral biases that get in the way of rational decision-making and can have a negative effect on the long-term growth of their assets. Some of us have FOMO – Fear of Missing Out – and others have LA – Loss Aversion. In fact, most of us have both! Long-term investing success requires us to overcome those natural biases. But how?

We’ve all heard that we’re supposed to Buy Low and Sell High but, in fact, many of us, if left to our own devices, do just the opposite. When the market is rising, and the media talks about it a lot, we tend to get FOMO. If everybody else is getting rich, I want some of that too! Buy! Conversely, when the market is diving, we acquire Loss Aversion. I can’t stand to see my investments go down! Sell, sell!

In fact, this fear of losing money seems to be hard-wired in almost all of us. Thaler said, “…losses sting more than equivalently-sized gains feel good.” The sage philosopher and former boxer, Mike Tyson, said it this way – “Everyone has a plan until they get hit in the mouth!” In other words, we make poor decisions such as selling when the market dives and making paper losses permanent, even when we really know better.

Now, it should be noted the U.S. stock market is in the midst of an 8-year Bull run where there has been little volatility since the recession in 2008. So, many of us may not even remember how we reacted when the market last tumbled.

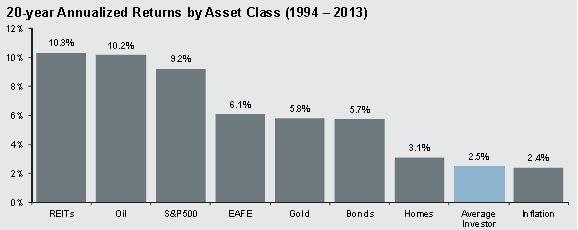

To see how our personal biases can negatively affect performance, the chart below shows how individual investors, the do-it-yourselfers, have fared much worse than they should have over a 20-year period (JP Morgan Market Insight):

To quantify this further, $100,000 invested in 1994 in the S&P 500 would be worth $581,370 by 2013, but only $163,862 if managed by the average investor on their own. That’s because most of us get influenced when the markets rise and fall and do the opposite of what is in our best interest when facing gains and losses – FOMO or LA hits us – and we irrationally Buy High and Sell Low.

So, how do you remove your emotions and invest with success?

• Analyze your long-term needs;

• Quantify your financial goals;

• Develop a plan with annual savings and investment returns goals;

• Structure a portfolio to support your plan;

• Rebalance your portfolio quarterly to stick to your plan.

Having a financial plan supported by a well-designed portfolio that allocates your investments appropriately for your individual circumstances will help remove your emotions and personal biases from the equation, resulting in better returns.